Huntsville’s Housing Boom: A 43% Inventory Surge Shakes Up the Market

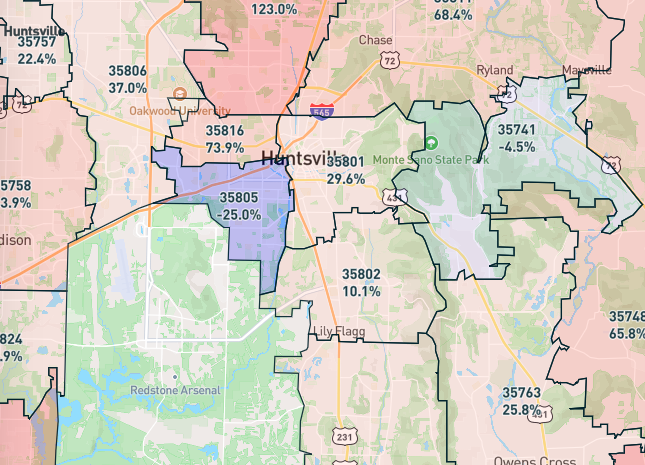

Huntsville, Alabama, the Rocket City, is witnessing a real estate revolution that’s hard to ignore. Fresh data from Realtor.com shows a jaw-dropping 43% year-over-year spike in homes for sale as of March 2025(based on Feb 2025 Realtor.com data). This flood of inventory is rattling the cages of local real estate agents, who’ve grown accustomed to a seller’s market where homes vanished faster than sweet tea at a summer barbecue. Now, with listings piling up, the dynamics are shifting—and it’s not just the agents feeling the heat.

For years, Huntsville’s housing scene thrived on scarcity. Buyers scrambled, prices soared, and agents rode the wave of quick sales and fat commissions. But this sudden swell of available homes is rewriting the rules. Sellers can’t just name their price and wait for the offers to roll in anymore—there’s too much competition. Agents are sweating through tougher negotiations, urging clients to list smarter or risk their property sitting idle. For those banking on fast closings, the longer days-on-market could mean leaner earnings, especially if prices start to dip.

Marketing’s getting trickier, too. With buyers pickier than ever, agents are pulling out all the stops—think 3D tours, glossy photos, and staged living rooms that scream “move-in ready.” It’s a far cry from the days when a blurry snapshot and a “for sale” sign were enough. Smaller outfits, strapped for cash, might struggle to keep pace, while the clock ticks louder with every unsold listing. And with high interest rates keeping some buyers at bay, agents are logging more hours showing homes to folks who aren’t ready to commit.

Yet, there’s a silver lining in this inventory boom, especially for younger buyers who’ve been priced out of the market. These folks, many in their 20s and 30s, have watched home values balloon beyond reason—paying top dollar for properties that weren’t worth half as much a decade ago. This surge in listings could finally ease that burden, offering a chance to snag a home without breaking the bank. It’s a glimmer of hope for a generation eager to put down roots without drowning in debt.

But here’s the rub: part of the problem traces back to baby boomers who won’t budge. Many snapped up their single-family homes decades ago for a song—prices that wouldn’t buy a shed today—and now they’re sitting tight, refusing to downsize. These sprawling, often empty nests are locked up in a time capsule of inflated value, while the boomers, aging gracefully or not, hold firm. It’s a bottleneck that’s choking affordability, leaving young couples staring down a future where starting a family feels like a luxury they can’t afford. As the elderly linger in oversized homes, slowly fading away, the next generation’s dreams of homeownership—and the stability to raise kids—stay just out of reach.

The inventory spike might nudge the market toward balance, though. More homes could tempt buyers back, especially if prices cool off. For agents, it’s a scramble to adapt—some are targeting high-end niches, others pivoting to rentals. The ones who thrive will be those who can roll with the punches. For Huntsville, this 43% leap isn’t just a statistic—it’s a turning point. Young buyers might finally catch a break, but only if the market can shake loose from the grip of yesterday’s bargains. In a city built on innovation, the real estate game is proving it’s not afraid to evolve.