Huntsville Business Outlook Cools in Q2 2025: Alabama Business Confidence Index Insights

Huntsville, AL - Huntsville’s economic optimism has softened in Q2 2025, as detailed in the latest Alabama Business Confidence Index (ABCI) report from the University of Alabama’s Center for Business and Economic Research (CBER). The statewide ABCI fell to 51.1, a 9.9-point drop from Q1’s robust 61.0, reflecting a shift to mild confidence in economic growth. Huntsville’s metro-specific ABCI registered at 49.5, dipping below the neutral 50 threshold, signaling a mildly contractionary outlook driven by concerns over state and national economies. This article explores what this means for Huntsville’s business community, a key driver of Alabama’s economic landscape.

Huntsville’s Q2 2025 ABCI: A Closer Look

The ABCI, a quarterly survey of Alabama business executives, tracks six indicators: Alabama and U.S. economic conditions, industry sales, profits, hiring, and capital expenditures. Huntsville’s Q2 ABCI of 49.5, down from 61.4 in Q1, reflects a cautious shift, with specific metro-level insights:

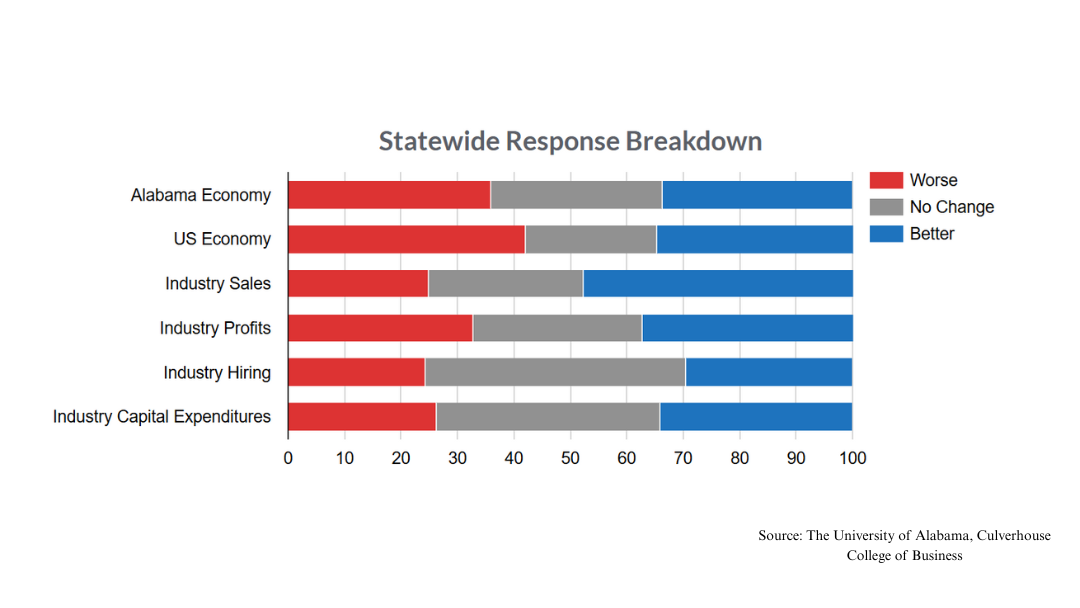

- Alabama Economy: Huntsville’s confidence in the state economy dropped to 47.5, a 15.6-point decline from Q1’s 63.1, aligning with the statewide index of 49.2, which fell 14.4 points. Only 33.7% of Huntsville panelists expect improved state conditions, while 37.5% anticipate a downturn.

- U.S. Economy: National economic optimism plummeted to 44.4, down 16.2 points from 60.6, mirroring the statewide index of 47.1. Over 42% of Huntsville executives foresee worse national conditions, compared to 34.8% expecting improvement.

- Industry Sales: Sales remain a bright spot, with Huntsville’s index at 54.2, down 9.4 points but still moderately expansionary. About 47.9% of panelists anticipate sales growth, reflecting resilience in sectors like aerospace and technology.

- Industry Profits: The profits index held steady at 51.1, a 7.4-point drop, indicating mild confidence in profit growth, with 37.4% expecting increases versus 29.5% predicting declines.

- Industry Hiring: Hiring confidence turned mildly contractionary at 48.9, down 12.5 points, with only 29.5% of panelists planning to expand hiring, while 23.9% expect reductions, a shift from Q1’s robust 61.4.

- Capital Expenditures: Investment plans softened to 50.7, down 10.3 points, hovering near neutral. Roughly 34.2% foresee increased spending, while 26.3% anticipate cuts.

Huntsville’s contractionary outlook contrasts with Mobile’s leading metro ABCI of 54.4 and Birmingham-Hoover’s 51.9, while Tuscaloosa (48.7) and Montgomery (48.3) also fell below 50.

Statewide Economic Trends and Huntsville’s Role

Statewide, the ABCI’s 9.9-point decline reflects fading optimism from Q1’s high, driven by contractionary forecasts for Alabama (49.2) and U.S. (47.1) economies. Despite this, industry sales (56.2) and capital expenditures (52.2) remain expansionary, with profits (50.9) and hiring (50.7) near neutral. CBER forecasts Alabama’s GDP growth at 1.6% for 2025, down from 3.0% in 2024, with employment growth at 1.4% (from 2.0%) and tax receipts rising 1.0% (from 2.7%).

Huntsville, a powerhouse in aerospace, defense, and technology, often outperforms state averages. However, the Q2 report suggests local executives are grappling with broader economic uncertainties, possibly tied to national inflation trends (forecast at 2.9% for 2025) or federal budget concerns. The city’s sales resilience, driven by firms like Boeing and NASA’s Marshall Space Flight Center, indicates sustained demand, but hiring and investment caution could slow expansion.

Industry-Specific Insights for Huntsville

The Q2 ABCI highlights varied industry performance statewide, with implications for Huntsville’s key sectors:

- Transportation, Information, and Utilities: This sector led with a 61.6 industry index, up 5.4 points, driven by strong sales (67.9) and profits (67.9) forecasts. Huntsville’s tech and logistics firms may contribute to this optimism.

- Manufacturing: With a 58.1 index, manufacturing remains confident, particularly in sales (63.0) and hiring (58.7). Huntsville’s aerospace manufacturing hub aligns with this trend, though profit expectations (56.5) are more tempered.

- Professional, Scientific, and Technical Services: This sector saw the steepest decline, dropping 19.5 points to a contractionary 45.0, with all components (sales, profits, hiring, capital expenditures) below 50. Huntsville’s tech startups may face challenges here, with hiring (42.1) and capital spending (43.9) particularly weak.

Huntsville’s economy, heavily tied to aerospace and technology, likely mirrors manufacturing’s resilience but may feel the pinch in professional services, where contractionary forecasts signal caution. Workforce training, a perennial concern noted in CBER’s annual surveys, remains critical for sustaining growth in these sectors.

Firm Size Dynamics

The Q2 ABCI reveals differences by firm size, relevant to Huntsville’s diverse business landscape:

- Large Firms (100+ employees): With an ABCI of 54.9, large firms are most optimistic, forecasting growth across all components, including hiring (55.2) and U.S. economy (51.0). Huntsville’s major employers, like Lockheed Martin, likely drive this confidence.

- Small Firms (0–19 employees): Small firms, with an ABCI of 51.0, remain mildly expansionary, particularly in sales (55.8) and capital expenditures (54.9), but expect weaker hiring (49.1) and national conditions (45.9).

- Mid-Sized Firms (20–99 employees): These firms are most pessimistic, with a contractionary ABCI of 47.8, forecasting declines in profits (46.0), hiring (49.1), and capital expenditures (45.5). Huntsville’s mid-sized tech firms may face tighter margins.

Large firms’ optimism could stabilize Huntsville’s economy, but mid-sized firms’ caution may limit broader growth.

What This Means for Huntsville Businesses

Huntsville’s Q2 ABCI suggests a pivot to caution, with executives bracing for potential economic headwinds. The contractionary hiring index (48.9) and near-neutral capital expenditures (50.7) indicate businesses may delay expansion plans, focusing on efficiency. However, the expansionary sales index (54.2) points to sustained demand in aerospace and tech, offering opportunities for strategic firms. Workforce development remains a priority, as skill shortages could hinder recovery if national conditions worsen.

Local leaders, including the Huntsville Area Chamber of Commerce, can leverage these insights to advocate for targeted support, such as training programs or economic incentives, to bolster mid-sized firms and sustain large firms’ momentum. The Chamber’s partnership with CBER underscores the value of local input in these forecasts.

Looking Ahead: Q3 2025 and Beyond

The Q2 2025 ABCI, the 94th consecutive quarterly report, reflects a cooling but not collapsing business climate. Huntsville’s executives are encouraged to participate in the next survey, open June 1–15, 2025, to shape Q3 forecasts. For detailed insights, visit CBER’s website at https://cber.culverhouse.ua.edu/alabama-business-confidence-index/.

Despite the dip, Huntsville’s economic fundamentals—anchored by its innovation ecosystem and defense contracts—position it to navigate challenges. By addressing workforce gaps and monitoring national trends, the Rocket City can rebound swiftly. Stay informed and engaged to keep Huntsville thriving in 2025.